I can’t lose in collective bargaining, right?

The Big Gamble

One of the standard promises of union organizers is better pay and benefits. They try to convince a group of employees that no matter what they have now, it will only get better if they “gang up together” and bargain as one large group. Unfortunately for the employees, that’s not how collective bargaining works. Here’s what the National Labor Relations Board says: “There is, of course, no obligation on the part of an employer to contract to continue all existing benefits, nor is it an unfair labor practice to offer reduced benefits.” MIDWEST INSTRUMENTS, 133 NLRB. NO 115

In other words, due to the give-and -take aspect of negotiations, you could lose what you already have. The company would not actively try to make things worse, but no one can predict what will happen once the horse trading of negotiations begins. The only guarantee a union can really give you is that you will have to pay union dues.

There are no guarantees in collective bargaining!

There are three parties at the bargaining table:

- The employees – you bring everything you currently have, ie. wages, benefits, 401(k), company match, incentives

- The company – brings the checkbook (or money)

- The union – brings nothing to bargain with. The only thing the union has to bargain with or trade, is the employees’ things

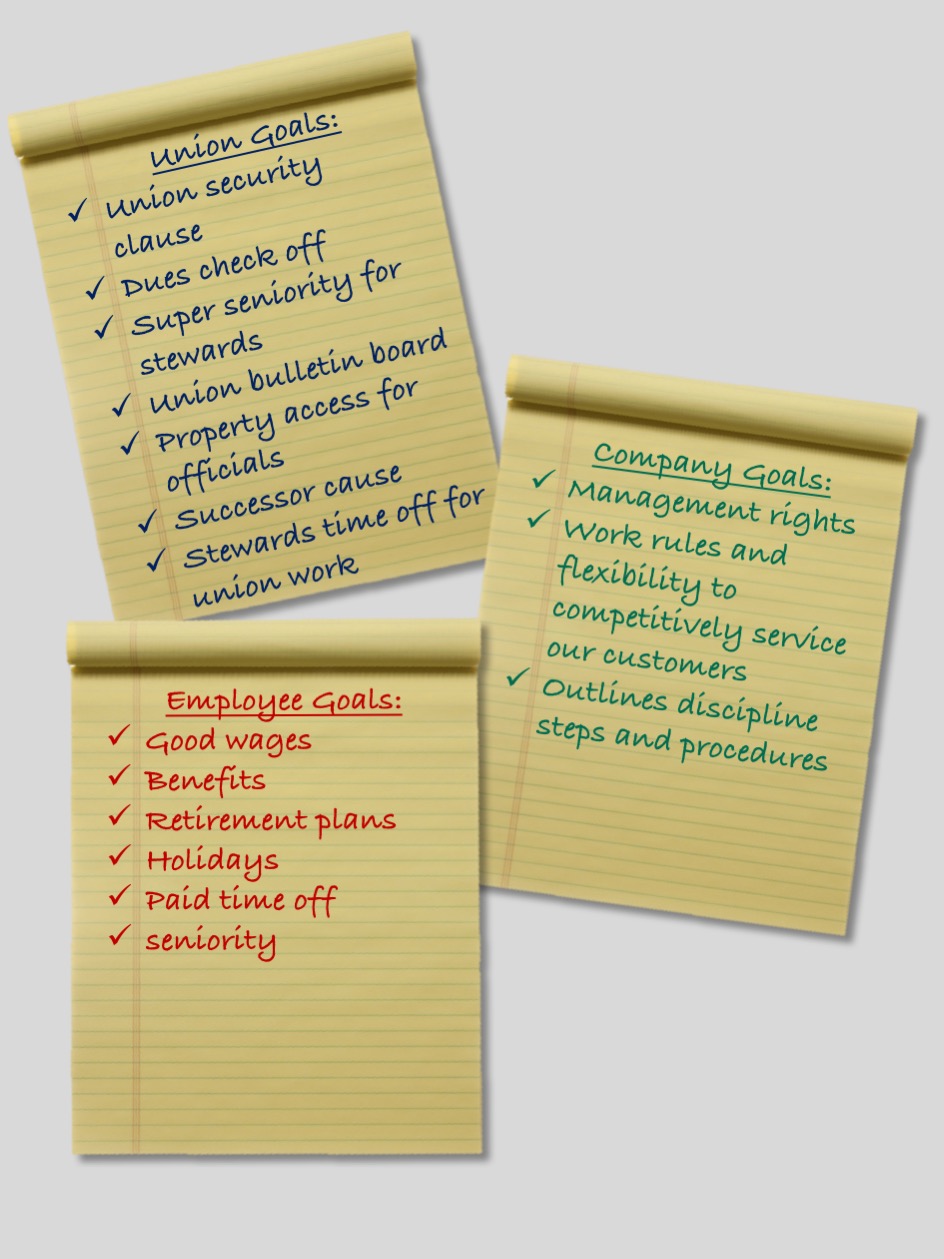

The outcome of negotiations is unknown – each of the three parties have things they want in the contract, and will “bargain” to get.

Negotiations could mean less benefits – bargaining is a give and take process.

You will not lose benefits because of union activity. But the outcome of negotiations is uncertain – you could get more, you could get less or you could stay the same (plus pay dues). There is no guarantee you’ll keep what you have now.

“Collective Bargaining is potentially hazardous for employees and as a result of such negotiations, employees could wind up with less benefits after unionization than before.”

COACH & EQUIPMENT SALES CORP., 228 NLRB No. 51

“Employees understand that a union cannot obtain increased benefits just by winning an election, but that benefits must be obtained through collective bargaining.”

BURNS INTERNATIONAL SECURITY SERVICES, 256 NLRB NO. 165

What Really Happens in Union Bargaining?

What former union officials and staff have to say…

What you have now – your bargaining chips:

- 40 Hours of PTO first year *hours increase after year 1, 3, 5 and 10 years up to 160 hours

- 6 Paid Holidays

- 1 Floating Holiday

- On-Call Bonus Pay for weekend and holiday

- 401K Retirement Plan*company match up to 50% of first 6% of employee contributions

- Health Plans*choice of multiple High Deductible or PPO plans

- Health Savings Account (HSA) with High Deductible Plans*can earn up to $1,700 in employer contributions to HSA

- Teledoc virtual care

- Hinge Health*digital physical therapy and pain management program

- Livongo*diabetes and weight management program

- Quantum*healthcare concierge service

- Vision and Dental Benefits

- Short Term Disability*100% paid for tenured employees

- Life and AD&D Insurance *1x annual salary for each benefit at no cost to employees

- Mental Health App & Employee Assistance Program for mental health, family resources and more, 100% employer paid

- Voluntary Benefits Available for employees needs

- Long Term Disability offered

- Accident, Critical Illness, Hospital Indemnity Insurance

- Home and Auto Insurance Discounts*payroll deduction available

- Identity Theft, Legal, Pet Insurance

- Dependent Care Flexible Spending Account

- Personal Leave of Absence

- $163 Prescription Safety Glasses Allowance

- $200 Annual Safety Shoe Allowance *eligible on 1 year anniversary date

- Referral Bonus up to $1500

- Daily Pay

- Outstanding Marks Recognition Program

- Employee Perks Program*Discounts on cars, cell phone service, travel, etc.

- Company Vehicle

- Partnership with Indiana Tech for locators and dependents

- 20% tuition discount

- 12 hours of credit for completing locator training

- Scholarships available

- Employee Relief Fund, in partnership with E4E, providing financial support to qualified employees after a disaster

Who Does The Bargaining?

The union will most likely hold a meeting of the members and ask what they want in the contract. It will likely be a very long “wish list.”

But at the bargaining table, the union does the talking; the union writes up and decides which proposals to make.

You have elected them as your representative to speak on your behalf, and ultimately decide on all the terms and conditions of your employment.